By Jess Fuller, Senior Director of Economic Impact

A thriving workforce depends on access to income-aligned housing, yet rising costs across the Denver-metro region are pushing employees farther away – forcing employers to grapple with longer commutes, talent shortages, and hiring challenges. The Greater Arvada Chamber continues to track the city’s supply of income-aligned housing by analyzing real-time inventory for sale or rent by zip code, particularly for those earning 60-120% of the Area Median Income (AMI), which this translates to roughly to between $55,000 – $155,000/yr in household income. These middle-income earners – including teachers, first responders, tech workers, hospitality staff, and nonprofit employees – are often priced out of the market, caught in what is known as the “missing middle” housing gap.

In a previous report, the Chamber found that less than 18% of Arvada’s workforce both lives and works in the city, meaning over 80% of local workers commute from outside areas. This report examined where Arvada’s workforce resides and compared median housing costs in the top populated zip codes to those in Arvada. With such a significant percentage of workers living outside of the city, does Arvada have enough income-aligned housing to meet workforce needs?

The lack of available and affordable housing means more workers are forced to live far from their jobs. According to Stacker, the average commute time to Arvada is 27 minutes, with 42% of Arvada’s commuting workforce driving 30 minutes or more one way. Research shows that employees with a commute of 15 minutes or less are 20% more likely to stay at their jobs.

As housing costs rise and income-aligned stock remains limited, local businesses are struggling to recruit and retain top talent. To address this challenge, the Greater Arvada Chamber’s B.O.L.D. 2026 Housing Initiative is working to expand access to income-aligned housing, ensuring workers can attain housing within reasonable proximity to their jobs. Providing these housing options is critical – not just for employees, but for businesses and the long-term economic health of the community.

This report was generated using labor data from Lightcast and real-time property supply data from exclusive broker data, Zillow and Redfin, adhering to 60-120% AMI housing cost caps set by Denver Housing Stability. For-sale housing within the 60-120% AMI range is capped at approximately $450,000, meaning that is the most a household at 120% AMI can pay for a home and still take care of their other expenses. However, according to Zillow, the median home price in Arvada is $618,750 (a 1.5% increase from last year) and $633,405 in Jefferson County. With home prices far outpacing affordability, tracking and expanding income-aligned housing options is essential to supporting a strong workforce and local economy.

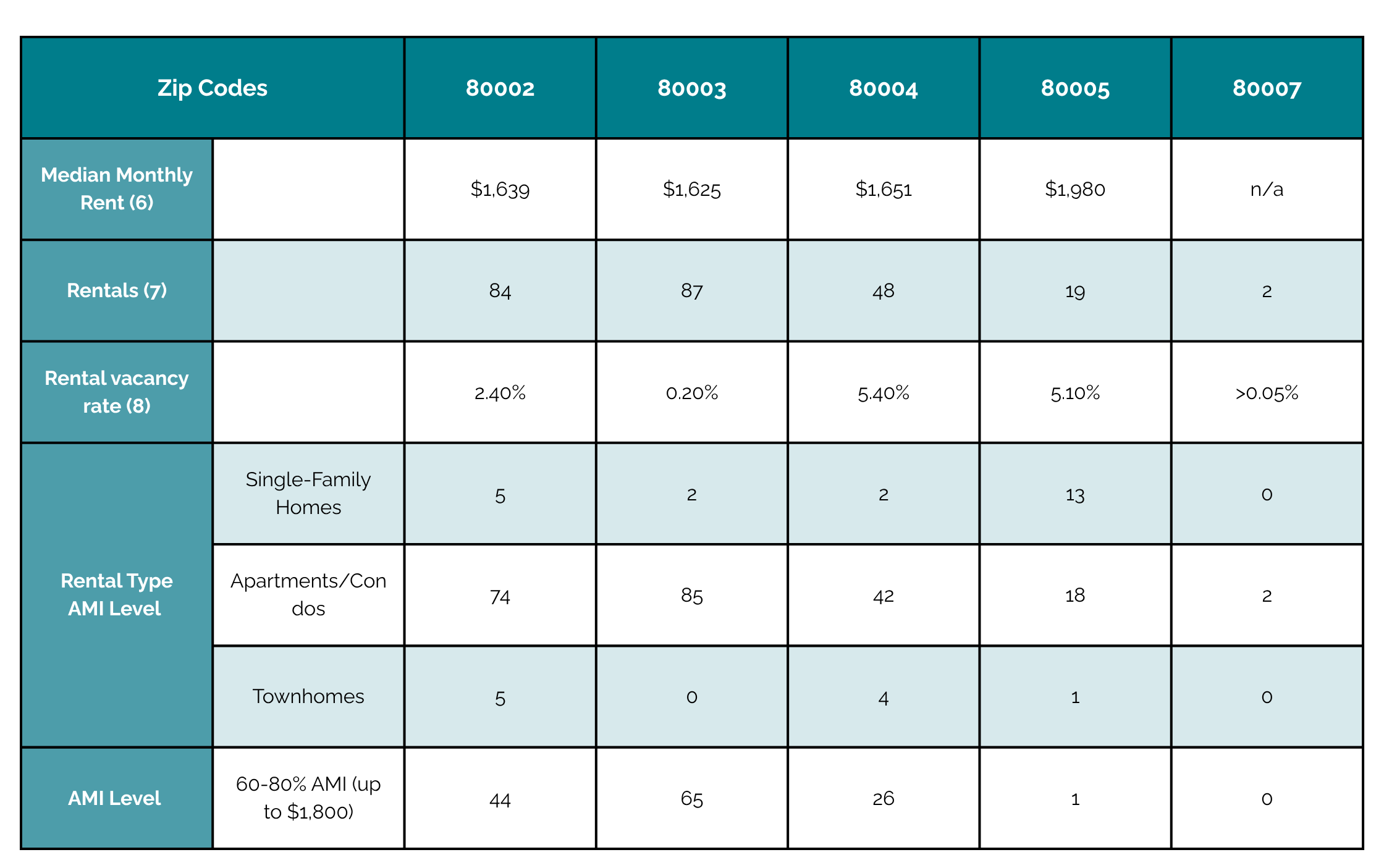

Apartments for rent (2+ bedroom and 1+ bathroom) are capped at $2,500/month for residents in the 60-120% income range, meaning that is the most someone at 120% AMI can typically pay and still take care of other expenses.

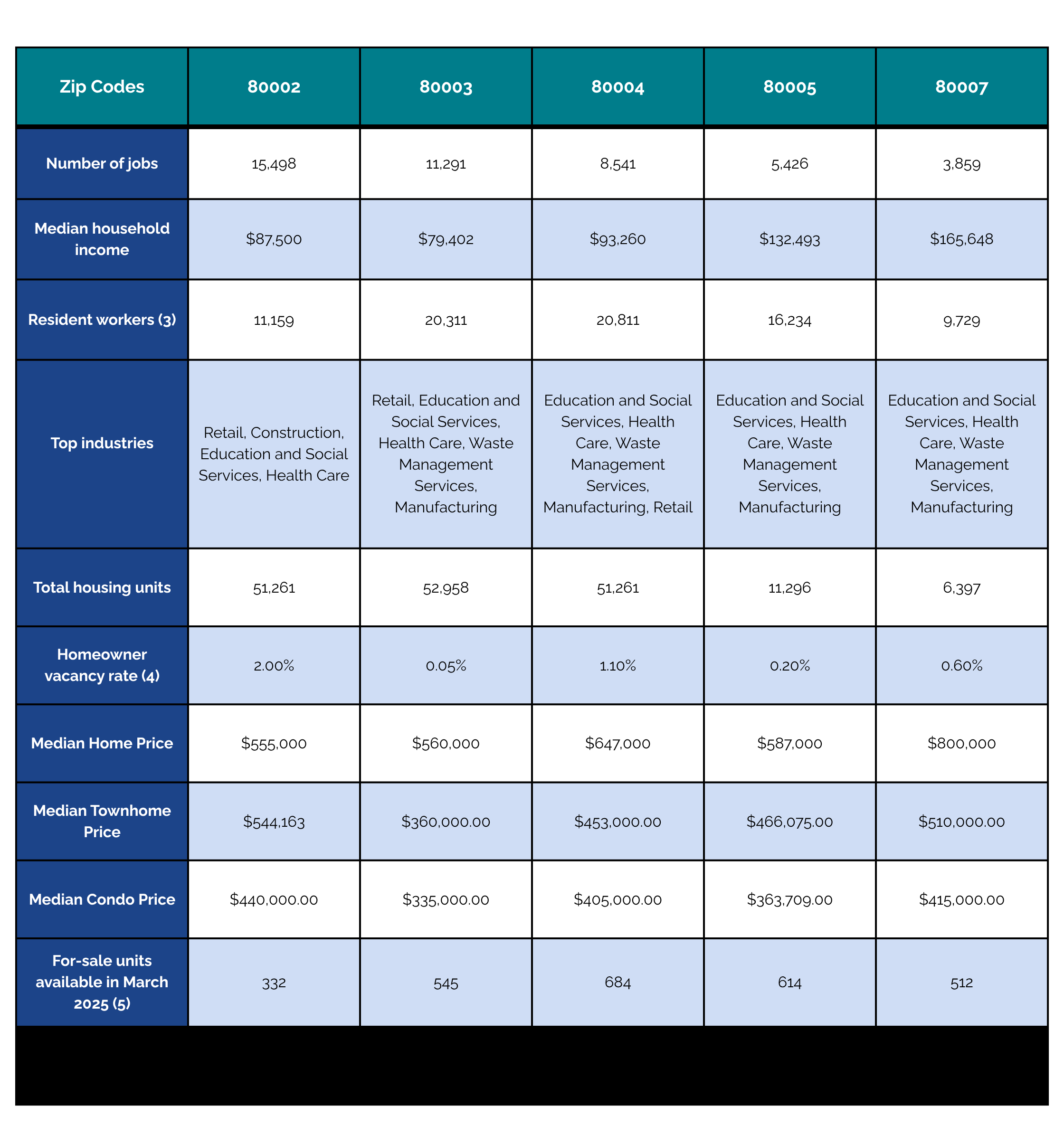

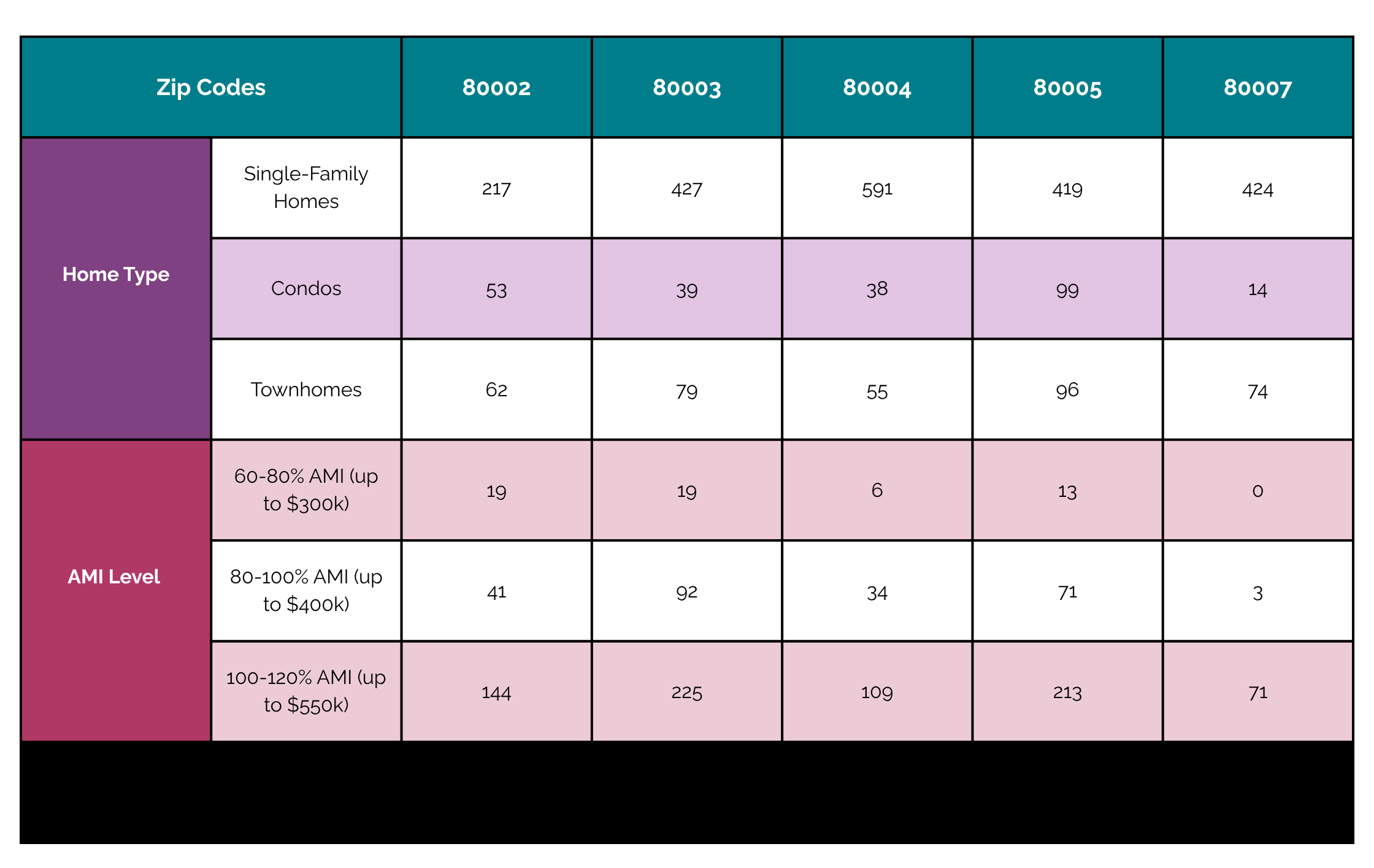

The below table breaks down the supply of different types of homes (single-family home, condo, townhome) for rent and sale in Arvada and the number of units that fall within the affordability range for people at those income levels by zip code.

AMI Housing by Zip Code1

Data is collected from Zillow, Lightcast, and Broker exclusives2 from Housing partners. Zillow and sources of the like do not reflect #’s that are broker exclusives. The for-sale housing stock includes all of the for-sale homes in March 2025. The rental housing stock includes all of the rental stock available on March 31, 2025, data was unavailable for all of the rental stock through March 2025. Please note: Some of these zip codes fall outside of Arvada into surrounding areas.

Notable Findings

The data reflects some key trends that shine a light on the housing burden experienced by the region’s workforce with some notable trends and findings.

- Those earning 60-80% AMI are able to afford the smallest share of affordable, for-sale housing stock in Arvada, followed by those earning 80-100% AMI. Those earning 100-120% AMI are able to afford the biggest share of the affordable, for-sale housing stock in Arvada within the 60-120% range.

- Condos have a lower median for-sale price compared to both the median price of townhomes and single-family homes, but make up only 9% of the total available for-sale housing stock. This makes up the smallest amount of for-sale housing stock. However, apartments and condos make up the largest percentage of rental housing stock.

- There is a higher rental vacancy rate across all zip codes compared to homeowner vacancy rates across all zip codes

- 80003 has the second lowest rental vacancy rate, but the most rental options for those earning 60-80% AMI and 80-100% AMI. 80003 also has the lowest homeowner vacancy rate9 and the highest number of total housing units with the second highest number of jobs in that zipcode.

Income-Aligned Housing Developments in Arvada

There are two income-aligned housing developments scheduled for construction in Arvada, offering up to 260 rental units and 20 for-sale units for individuals and families earning up to 70% of the Area Median Income (AMI). Both projects will be located in the 80002 zip code, which has the highest concentration of jobs in Arvada. This makes 80002 a strategic and desirable location for income-aligned housing, enabling more workers to live closer to their places of employment.

As the data shows, Arvada currently lacks sufficient income-aligned housing across all zip codes. This shortage places a significant burden on the local workforce, particularly for those earning between 60% and 120% of AMI.

The accompanying data table highlights both local and regional trends contributing to this challenge. Workers earning 60–120% AMI have limited options to rent or buy housing locally, and those within the 60–80% AMI range face the greatest barriers. While individuals earning 100–120% AMI may find more housing opportunities—including in higher-priced zip codes—those in the lower income range are largely priced out of for-sale options and have fewer rental choices.

There is a clear need for a broader range of housing types, such as condos and townhomes, to support moderate-income earners who wish to live near their workplace. Without increased investment in income-aligned housing, Arvada’s workforce will continue to face affordability challenges—and more local employers are recognizing housing availability as a growing barrier to attracting and retaining talent.

Resources

- Join the Housing Network to stay informed on progress of the Housing Initiative and opportunities to get involved as a business leader, community leader, or housing partner.

- Become more involved by taking a few minutes to share how your business has been impacted by housing, and learning how business leaders can advocate… for income-aligned housing locally through the Housing Advocate Program and Housing Advocate Workbook resource.

- Learn more about Arvada’s goals around housing in the Arvada Housing Strategic Plan (last updated in 2024). The Housing Strategic Plan identifies, prioritizes, and recommends housing goals, policies, programs, and resources to address housing needs in Arvada.

- Check out the 2023 City of Arvada Housing Needs Assessment. This assessment is completed by the city every six years

- Review Jefferson County’s 15 Year Housing Strategic Plan which is designed to address needs across the full spectrum of housing to help create vibrant communities where housing is accessible to all.

- The Jeffco Housing Blueprint is a regional plan developed in collaboration with regional municipal leaders, housing partners, and economic development partners, to explore innovative and effective solutions for middle-income housing challenges.

- To learn more about the housing needs from Jefferson County residents, check out the Jeffco Housing Survey completed by the Jeffco Community Network. The survey shares the community’s view about current housing challenges and future solutions.

- The B.O.L.D. 2026 Housing Initiative continues to explore innovative solutions to ensure access to income-aligned housing options for the workforce through a variety of programming, events, and resources for employers and housing partners. Learn more at our website.

Annotations

- Depending on the source the below data was pulled from, it may be showing point-in-time, monthly or annual averages.

- A broker exclusive sale is a real estate transaction where a property is marketed and sold without being publicly listed on the Multiple Listing Service (MLS). Instead, it’s promoted only within the listing brokerage’s internal network, often to clients, other agents within the brokerage, or a curated group of buyers.

- Resident Workers: residents living in this zipcode who are working (may be working in Arvada or outside of Arvada)

- Homeowner Vacancy Rate: % of homes compared to total number of homes in the zip code that are open and available to buy. Note, this data represents the average vacancy rate in each zip code over the last year.

- For sale units capped at approximately $450,000 to illustrate available units that are affordable for people with 60-120% AMI. Includes homes, townhomes and condos

- Median Monthly Rent for all home types

- Rentals: Rentals available capped at approximately $2500/month with at least 2 bedrooms and 1 bathroom to illustrate the average rental type affordable for people earning 60-120% AMI. Includes apartments/condos, homes, and townhomes. 2 bed 1 bath is generally the most desired layout for people in this range because it meets their needs.

- Rental Vacancy Rate: % of rentals compared to total number of rentals in the zip code that are open and available over the past year. Note, this data represents the average vacancy rate in each zip code over the last year.

- Homeowner Vacancy Rate: % of homes compared to total number of homes in the zip code that are open and available to buy

0 Comments