The Arvada Chamber has assembled explainer posts for five major Colorado laws that impact businesses in 2024. Read below for this legislation’s eligibility, key dates, and the requirements for businesses.

Colorado Bills 101

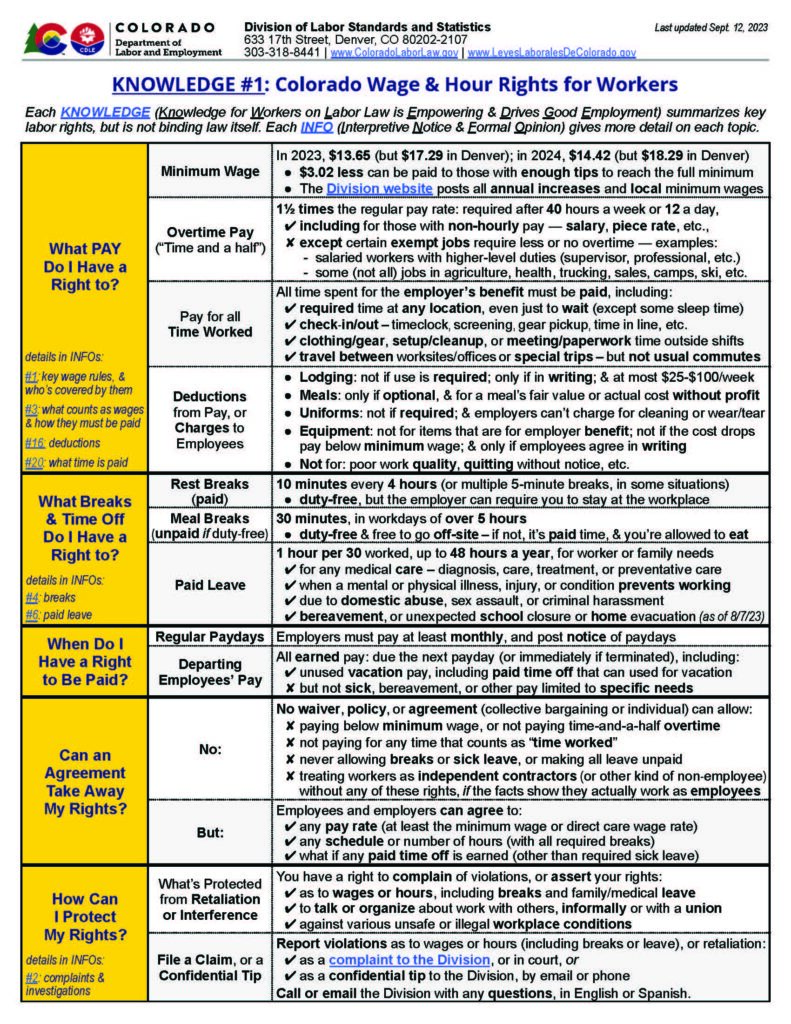

Colorado’s Minimum Wage Increase

Effective as of January 1st, Colorado’s minimum wage increased to $14.42 per hour for non-tipped labor and $11.40 per hour for tipped labor. This is a 77-cent increase from the prior minimum wage of $13.65. This year’s increase makes Colorado’s minimum wage the 7th highest in the country.

While the statewide minimum rests at $14.42, state law allows local governments to set their own minimum wage within their boundaries, as long as they are at or above the state minimum. Local governments in Denver ($18.29), Edgewater ($15.02), and unincorporated parts of Boulder County ($15.69) have chosen to do so.

Tipped labor

In 2024, employers can pay employees $3.02 below the minimum hourly wage if those workers make enough in tips to reach the full minimum. That equates to $11.40 per hour for tipped employees. According to the state’s Labor Department, tipped employees are defined as any employee who makes more than $1.64 per hour in tips, such as most bartenders or servers. If an employee’s wage after tips does not add up to the state minimum wage of $14.42 an hour, the employer must make up the remaining pay in cash wages.

Overtime pay

Employees in Colorado are entitled to overtime pay after 40 hours of work in a week, 12 hours of work in a workday, or 12 consecutive hours of work regardless of the start and end of the workday. Overtime hours cannot be averaged over two or more weeks. For example, if an employee worked 60 hours in one week and 20 hours the next, they would be entitled to 20 hours of overtime pay for the first week, even though their two-week average was 40 hours.

Overtime rates are calculated at 1 ½ times the regular hourly rate. Overtime pay at the Colorado minimum wage would be calculated at $21.63 per hour of overtime worked. Overtime must also be paid to many workers who do not make an hourly rate, such as those earning salary or piece rate pay. Some salaried employees with higher-level duties are exempt from overtime pay, as are some (but not all) employees in certain industries such as agriculture, camps, commissioned workers, or seasonal workers. See the full list of exemptions from the Department of Labor here.

Time that must be paid

Colorado law requires that employers pay for all time spent on the employer’s behalf. That includes all required time at any location, travel time between locations (excluding regular commutes), or setup and cleanup time outside of regular shifts. Employees are able to take 10-minute paid breaks every four hours, and will be given at least 30-minute breaks (paid or unpaid) for every shift of at least 5 hours. All employees must be paid at least monthly, and be made aware of paydays.

Deductions

Deductions can only be made from employees’ pay for optional expenses. For example, employers cannot take deductions out of employee pay for required uniforms, travel, meals or other expenses that are taken at the employer’s benefit. Deductions also may not be made for poor work quality or for quitting without notice.

Summary

Overall, the vast majority of workers in Colorado are entitled to at least $14.42 per hour, and those working in areas with a higher minimum are paid that city’s minimum wage. Additionally, overtime work must be paid at 1 ½ times the minimum, which equates to $21.63 per hour in 2024. Tipped labor can be paid at $11.40 per hour, as long as employee tips bring their wage to at or above $14.42 per hour.

More Information

Information from the Colorado Department of Labor and Employment is provided to help employers and employees understand these changes. Colorado Wage & Hour Rights for Workers here summarizes labor rights while Interpretive Notice & Formal Opinion (INFO #1) provides more detail.

Through the B.O.L.D. 2026 initiative, Advocacy KAPS Council, the Jefferson County Business Lobby (JCBL), and consistent outreach to elected officials at all levels of government, the Arvada Chamber strives to stay informed on the latest policy developments while advocating for a strong local economy. Find resources and ways to engage at arvadachamber.org/advocacy.

0 Comments